On the consequences of the collapse of FTX

The events of recent weeks associated with the fall of the largest player in the crypto industry have greatly stirred up the market. While the range of affected retail users is defined and significant, FTX’s institutional clients could have a more serious impact on the market.

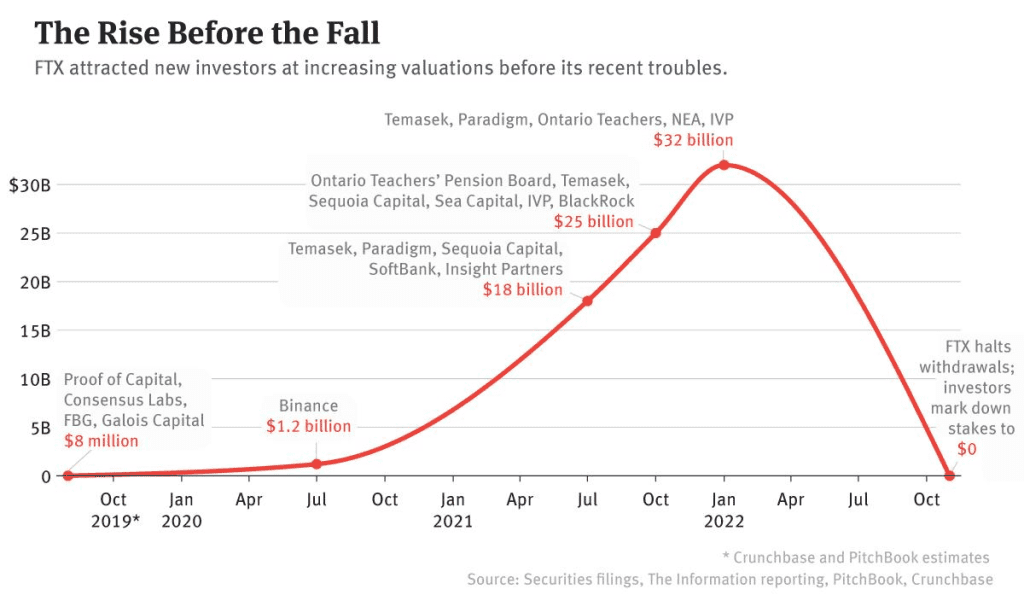

It should also be noted that the bankruptcy of FTX is considered in the context of the financial insolvency of the venture capital company Alameda Research, whose participation in crypto startups is one of the largest in terms of the number and volume of investments.

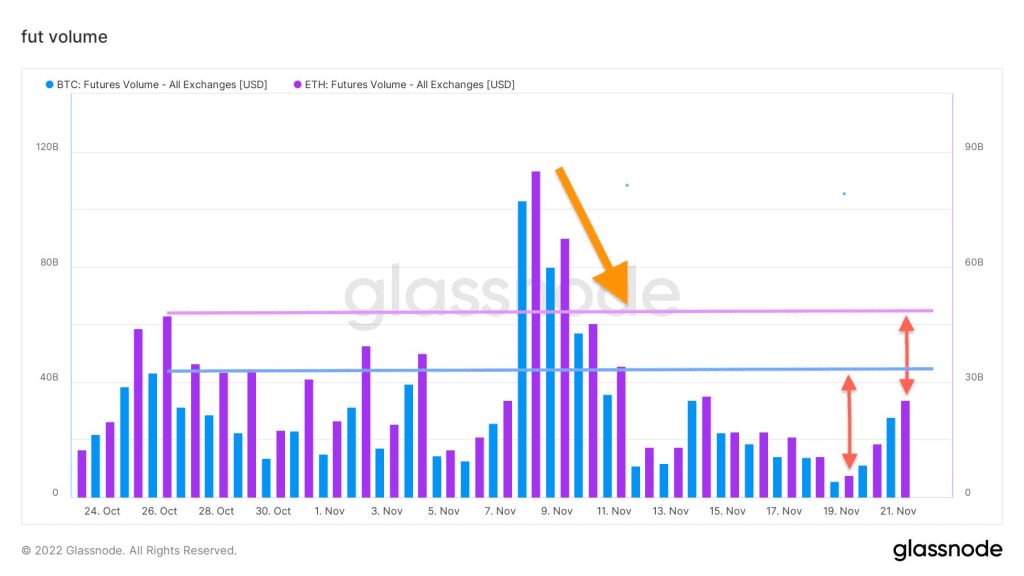

To assess the consequences, it makes sense to consider the overall picture of the market, and then clarify the details. For example, the situation in the derivatives market is quite clear:

Futures trading volume has fallen significantly after a surge at the time of the release of the main news about the cancellation of a possible takeover of FTX by Binance. From highs of $100 billion and $84 billion to around $25 billion for both cryptocurrencies, the decline was about 75%! In relation to the average values before the events, the drop was about 40%.

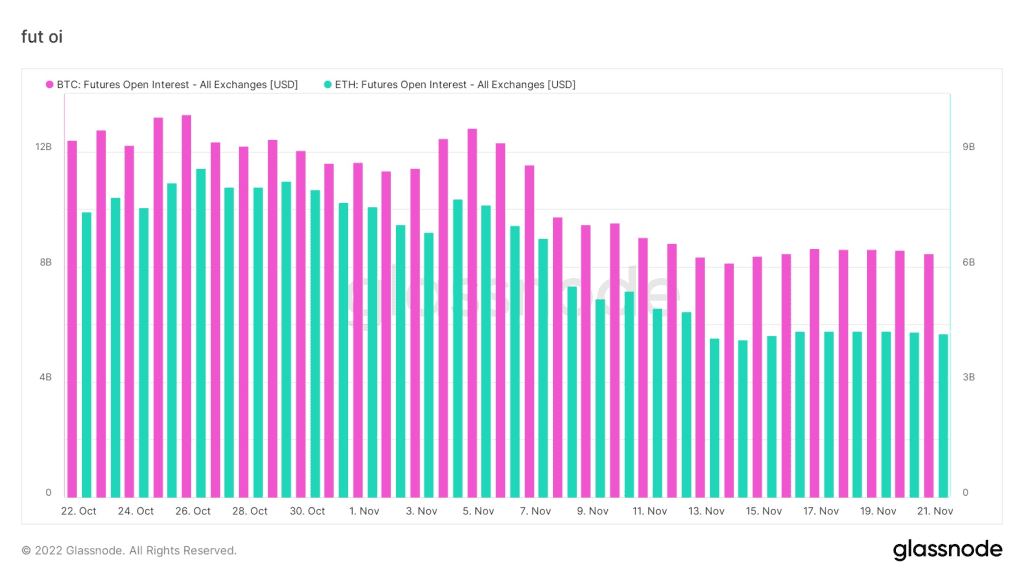

Even more obvious is the decrease in the volume of open interest for futures (including futures and perpetual contracts). From the usual figures of 12 and 10 billion for Bitcoin and Ethereum, respectively, the figures fell to levels of 6 and 4 billion – minus 50% from the level at the beginning of the month.

The fall in FTX affected, for example, market activity – through a decrease in the actual trading volume due to the exclusion of liquidity and the “engine” of the exchange and through the loss of confidence between large market participants.

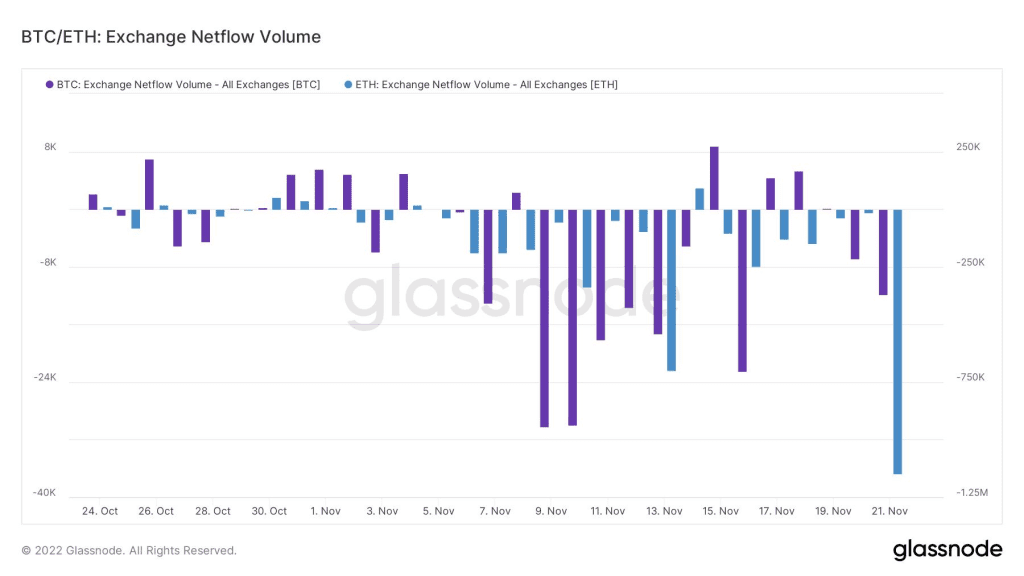

After it became clear that FTX still had liquidity problems, and they are quite large, all centralized exchanges faced a massive withdrawal of cryptocurrencies from their balance sheets. In total, about 120,000 BTC and 2,700,000 ETH were withdrawn within a week. At the moment, this liquidity is in the wallets of users who have either taken a wait-and-see attitude or have become more active in decentralized exchange and trading solutions.

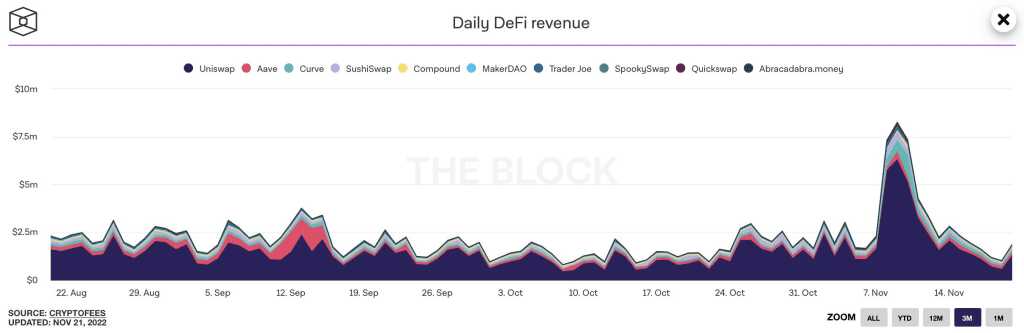

The surge in revenue generated by the main DeFi protocols – Uniswap, Curve, Compound, AAVE, and others – indicates both an influx of users and liquidity. However, it will be clear in the future how sustainable the trend of using DeFI will be, while it is too early to talk about the long-term effect.

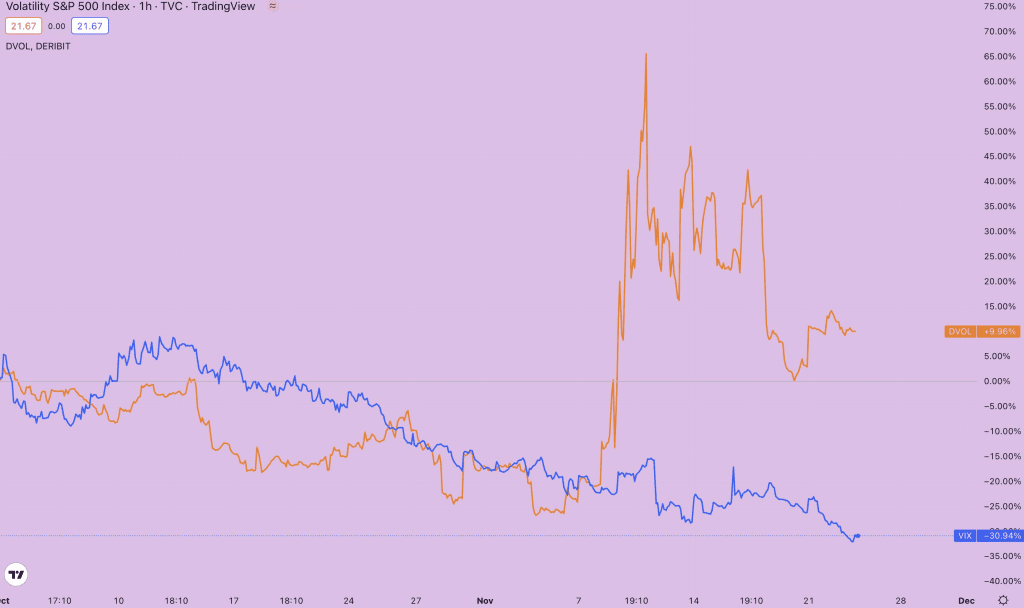

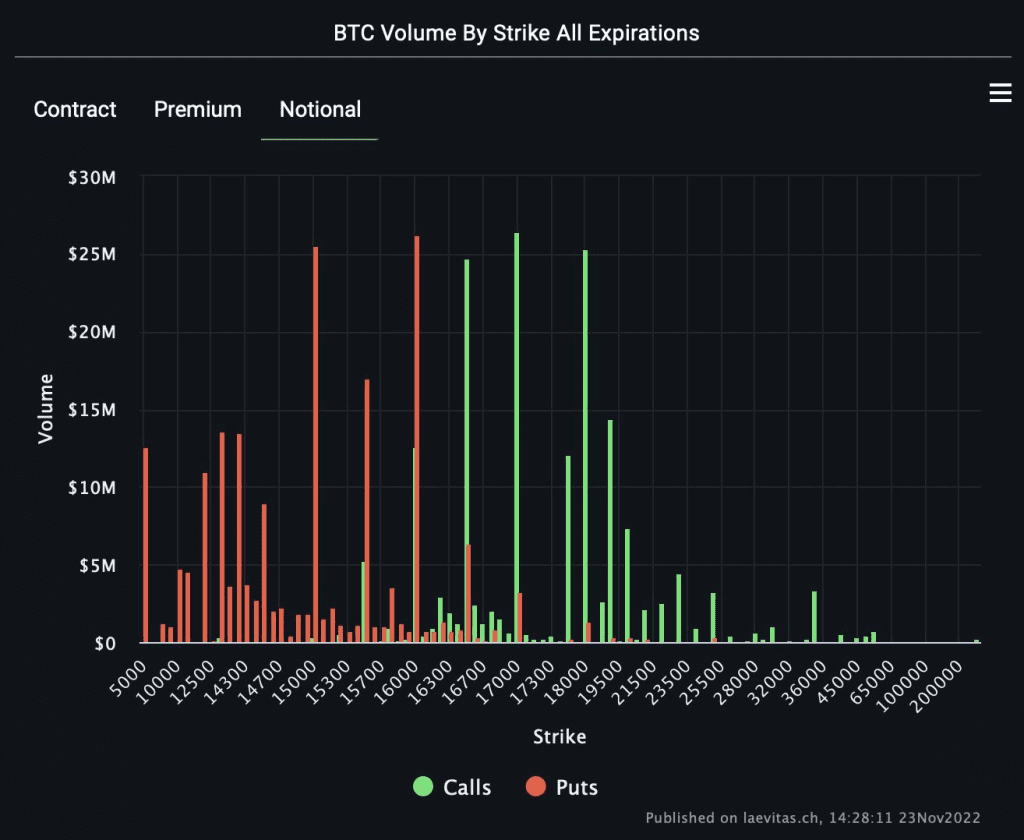

The situation with FTX took by surprise not only ordinary users and traders, but also large market makers in the options market.

The spike in volatility from November 7 to 11 began with tweets about a possible FTX acquisition by Binance and peaked after the deal was abandoned and filed for bankruptcy. Most of the activity was centered around put options with strikes of 15,000-16,000 for Bitcoin (1,000 and 1,100 for Ethereum).

Despite the fact that the market has stabilized, liquidity still has not fully returned to it. Options on the Solana token (SOL) are available only on existing strikes – there will be no new ones, in fact, starting from the new year, the options market for SOL will be closed or at least will be paused. This situation indicates the absence of a market maker and (or) unwillingness to organize further trading on this token.

In addition to the write-off of investments in the product itself – the FTX exchange (Tomasek, Sequia, Ontario Teachers Pension Board have already announced this), many large companies working with institutional traders or using cross-platform solutions for crypto trading are faced with the inability to return working capital. The most striking examples that are already known are Genesis Trading, MultiCoin Capital, Asian derivatives exchange AAX.

The most difficult situation has developed around the DCG crypto holding, whose trading arm Genesis has $ 2.8 billion in “difficult to collect” debts. The company received such “difficult” debts as a result of the bankruptcy of 3 Arrow Capital in the summer and now FTX. The consequences of the bankruptcy of the largest borrowers are extremely serious and could potentially spill over to the crypto industry flagship Grayscale Trust (also part of the DCG holding), on whose balance sheet there are 655 thousand BTC and 3 million ETH. The use of trust shares as collateral for a loan in initial or crypto form, together with a discount to market value, creates the problem of accounting for this asset on the balance sheet. In theory, 1000 shares of GreyScale of the trust is equal to 1 Bitcoin on the balance sheet, but now there is a very large discount on the market – about 50% to the value of the share, and the actual value differs from the book value. Because of this, the paper became liquid collateral for a number of Genesis Trading transactions, as a result of which the company needs an additional capitalization of $500 million.

As a result of the collapse of FTX, a lot of people were affected – retail investors and traders, investment companies and venture capital funds. Only the Binance exchange looks relatively well-established, having published the addresses of its wallets with reserves of more than $50 billion and therefore resisting a wave of panic and withdrawals of deposits, Coinbase, whose main competitor in the US market went bankrupt.